G/L Account Determination in SAP SD

G/L Account Determination in SAP SD

Most of the transactions in SAP are recorded against the GL account. During creation of billing document form a sales order , an accounting document is created where material value is posted against a G/L account. The post describes how the system determines the G/L account for a material sold to a particular customer by the GL account determination technique.

Lets try to create a sales order for a customer with some material and then creating a billing document from the sales order which also generated the accounting document.

To create sales order go to Tx- Va01

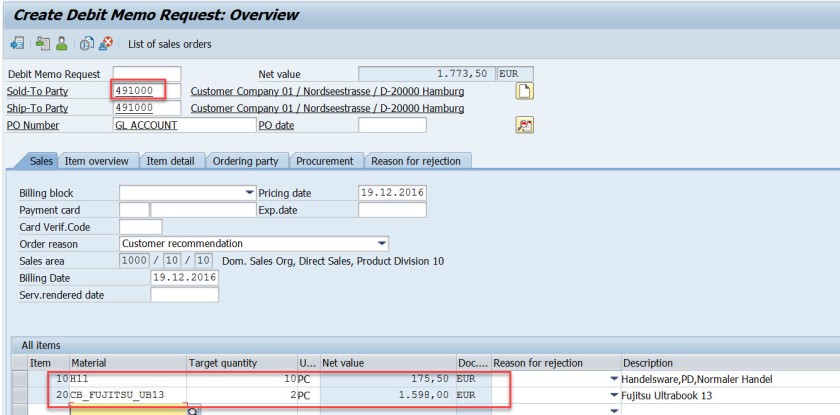

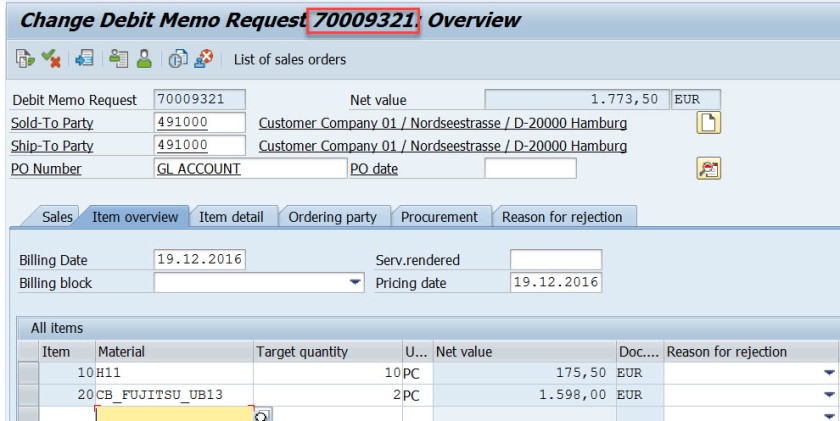

Lets create a debit memo request for the sales area 1000/10/10.

Provide the customer number and few materials and its quantity and double click on the first material to see the item details.

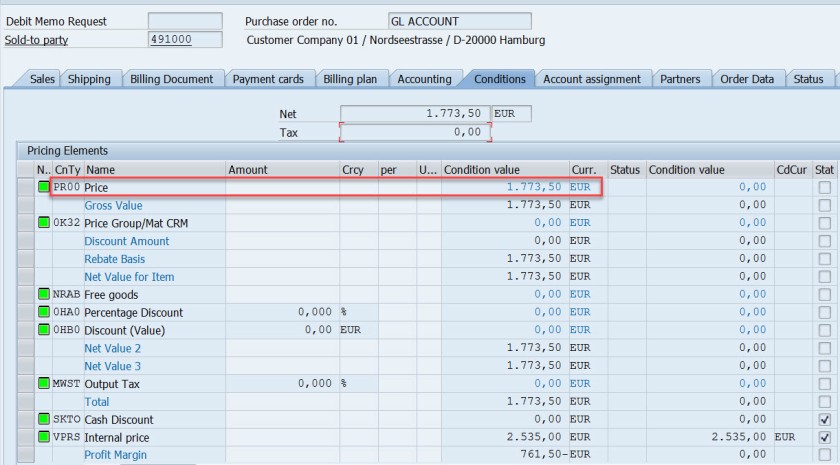

From the pricing procedure – for the pricing condition type- PR00 material value is calculated as 175.50 EUR.

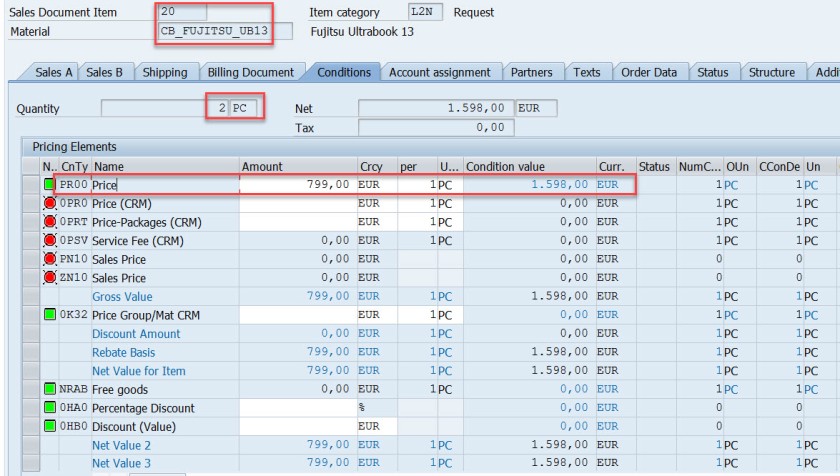

For the second material for the pricing condition type- PR00 material value is calculated as 1598.00 EUR. Go back.

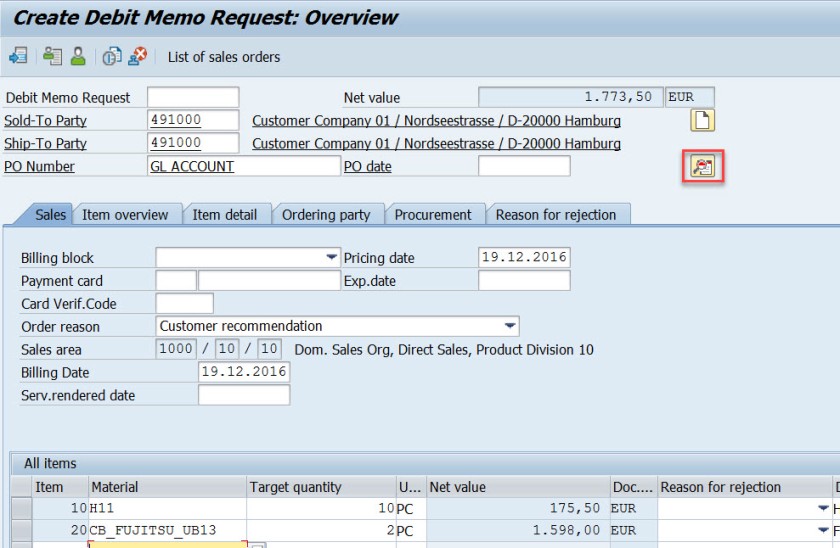

Select the header button.

In the header section, in the Conditions tab, the total price is the sum of two materials.

Save and DMR is created.

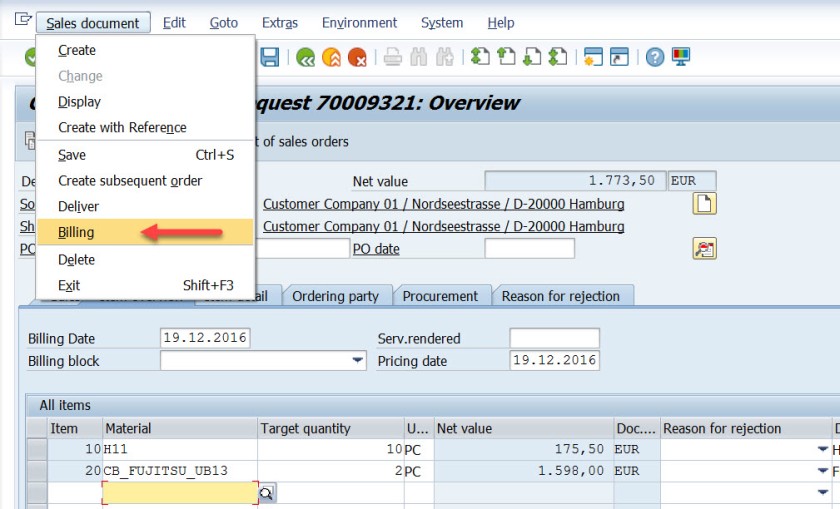

Go to Tx- VA02 and from the menu choose Billing.

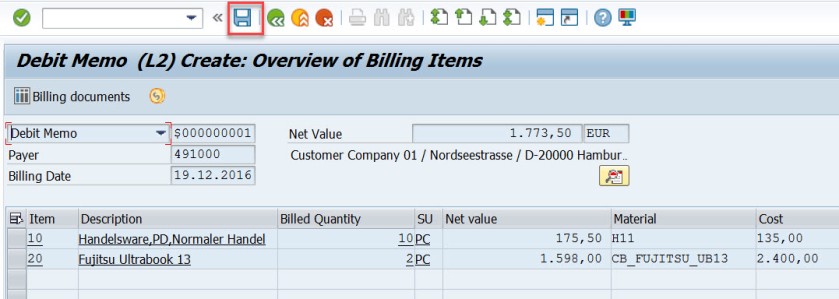

Select Save button to create a billing document. mark billing document type is determined as – L2.

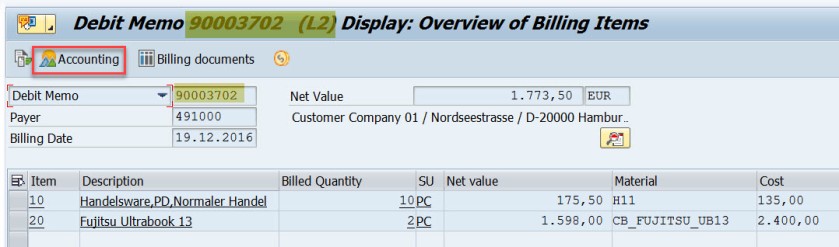

Go to Tx- VF03 and display the billing document. Choose Accounting button.

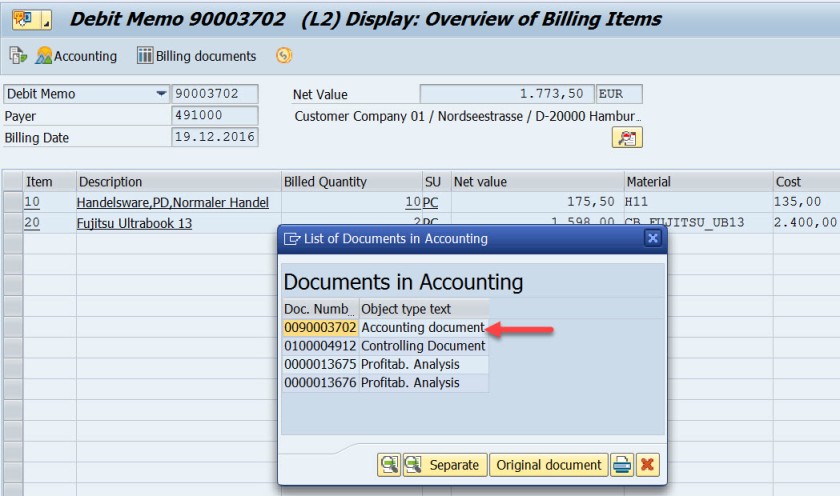

Choose Accounting document.

Here is the accounting doc with few lines.

First entry is for the customer as we used the customer – 491000, the account becomes 491000 for the customer.

For the second line, the GL account calculated as 502000. Let’s figure it out how this g/L account is determined.

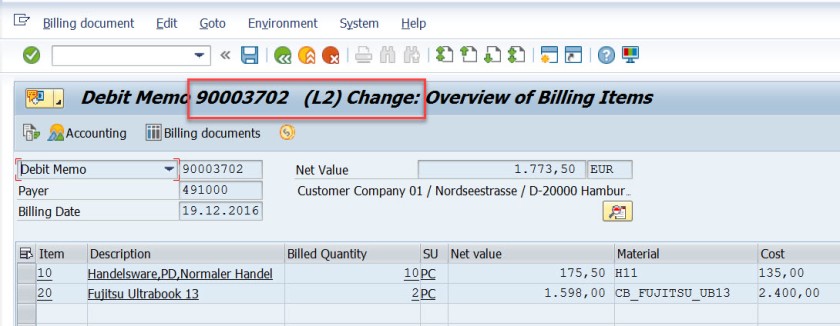

Go to Tx- VF02 and edit the billing document.

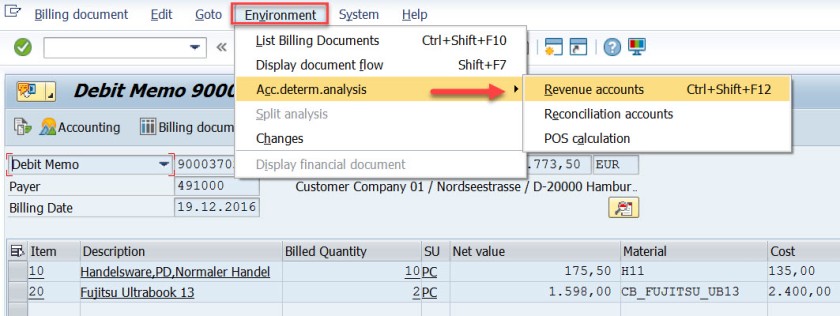

From menu, navigate along the highlighted path.

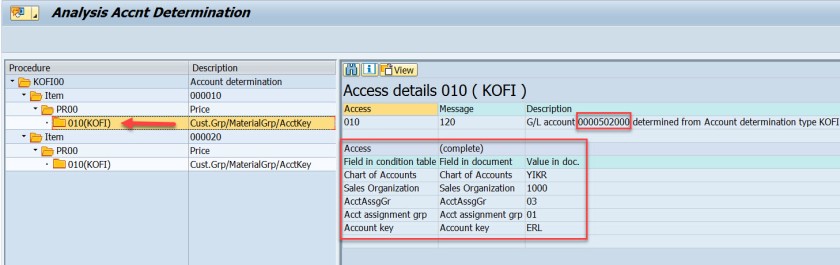

Well, it says the Account Determination procedure is KOFI00 and for the first item , for the pricing condition type PR00, the G/L account as 502000.

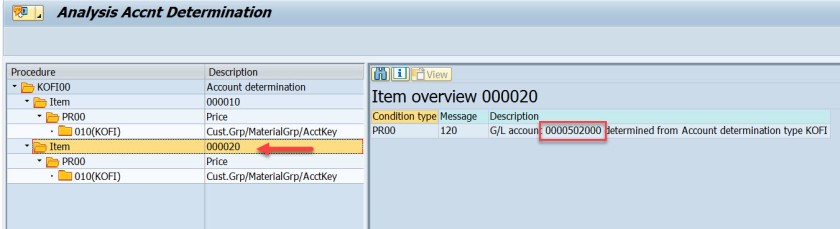

Same for the second item.

The G/L account determination requires few customizing steps.

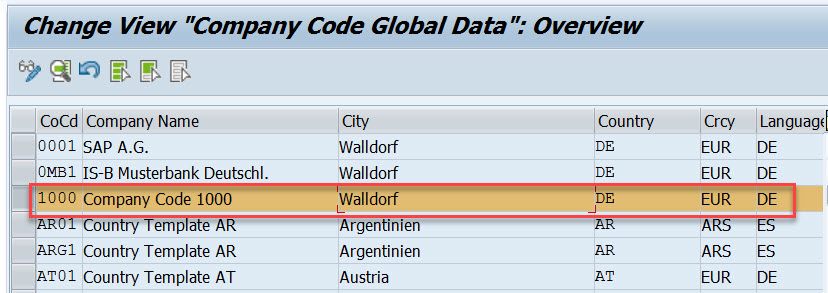

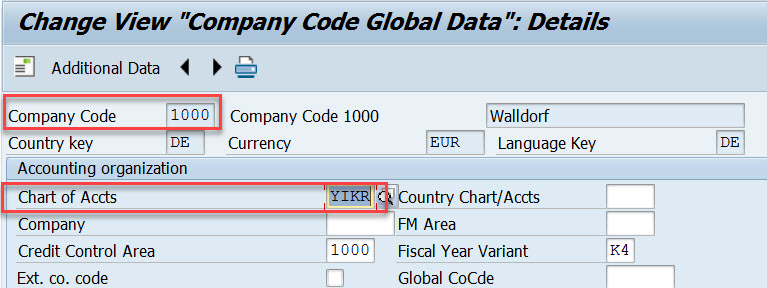

First check what is the chart of account assigned to the company code. In SPRO IMG structure navigate along the highlighted path to see the chart of account assigned to the company code.

For the demo we use company code- 1000

The chart of account is – YIKR

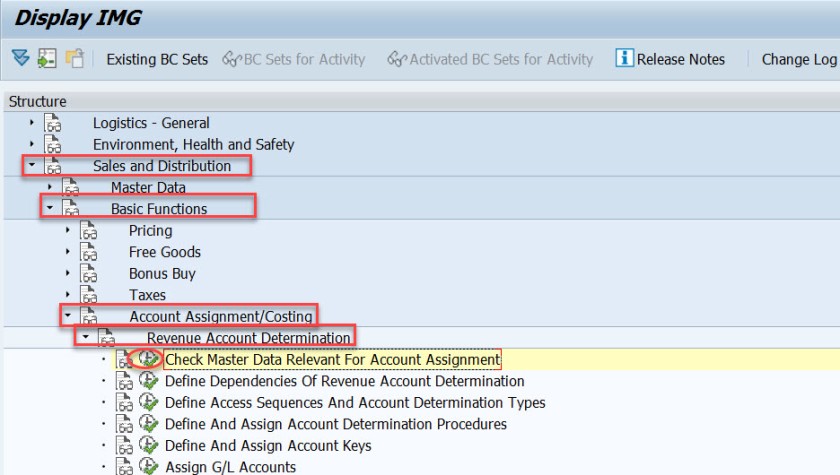

Next step , the customizing in the Sales&Distribution section for the Account Assignment/Costing.

First execute – Check master data relevant for account assignment.

Select first option- Materials : Account Assignment Groups.

Here Material account assignment group is created which is assigned to the material master when created in Tx- MM01

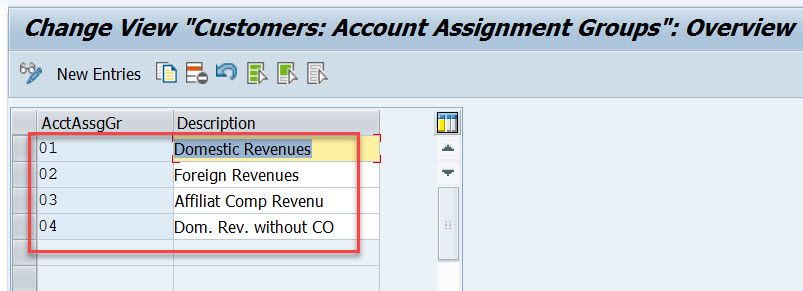

Select second option- Customer : Account Assignment Groups.

Here Cusomter account assignment group is created which is assigned to the customer master when created in Tx- XD01

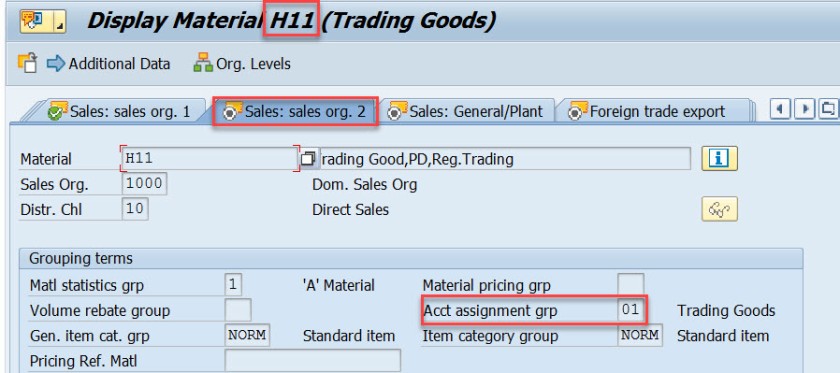

For our used material in sales order- H11, open this material in Tx- MM03 and in the Sales: sales org.2 tab, the material account assignment group is assigned to the material.

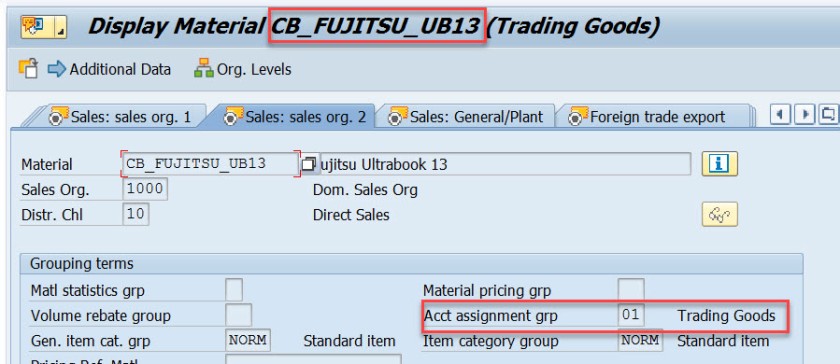

Similarly for another material used in sales order, it is assigned to the material account assignment group.

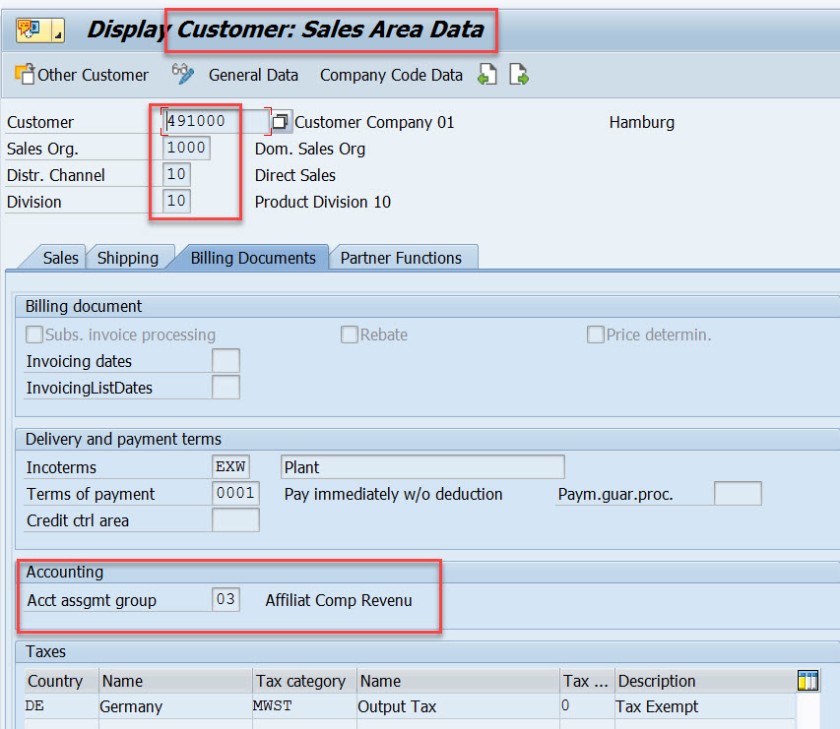

For our customer – 491000, open this customer in Tx- XD03 and go to the sales area data & in the billing document tab, customer account assignment group is assigned to the customer.

This customer and material account assignment group will help to determine the GL account.

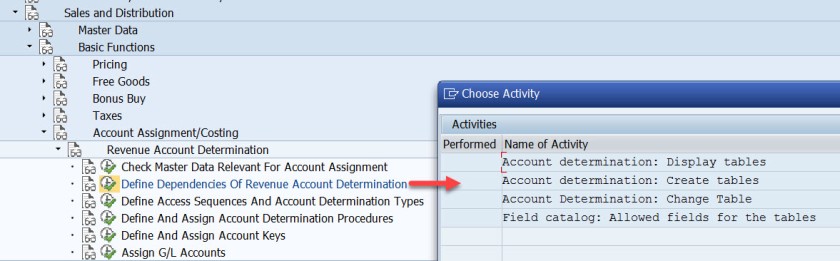

GL account determination uses the condition technique. Now the next step is to define the condition tables. So choose option- Define Dependencies of Revenue Account Determination. If you want to create new tables you can choose Create Table option. For this demo we are leaving this as already we have few condition tables.

Next is defining the access sequence and the condition type. So choose the highlighted opton.

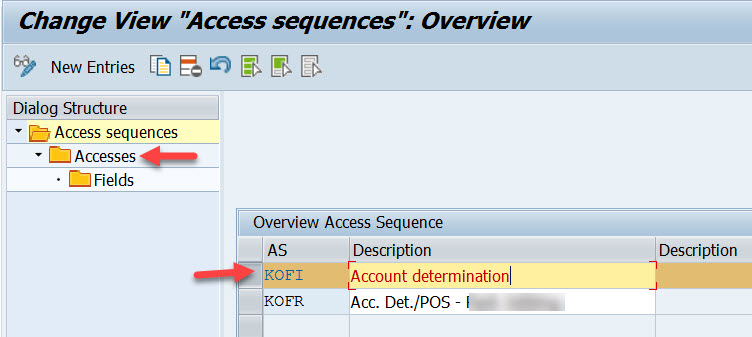

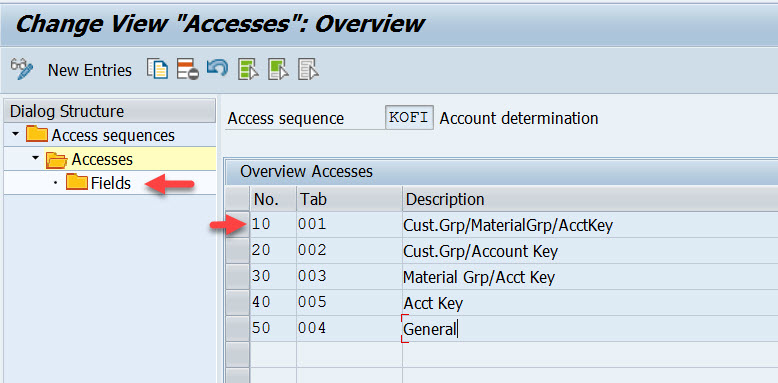

Access Sequence is defined as – KOFI( a new access sequence can be created bu New Entries button ). Select the access sequence and choose Accesses from left hand section to see all the access lines with condition table.

Well this access sequence KOFI has five access line each refers to one condition table.

Select one access line and choose Fields button to see all the fields included in the condition table to form the access line 10.

Access line-10 with condition table 001 has 4 fields.

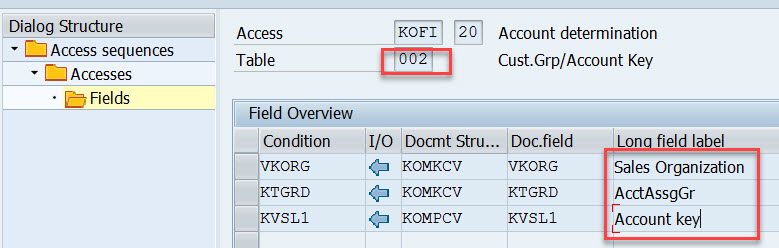

Similarly for other access lines with condition tables other fields are there.

For access line 30.

For access line 40.

For access line 50.

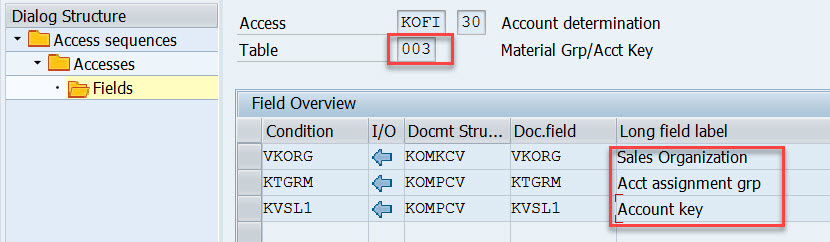

Choose Define Account Determination type.

Here Condition type- KOFI is created which is assigned to the access sequence KOFI which has 5 access lines with different condition tables.

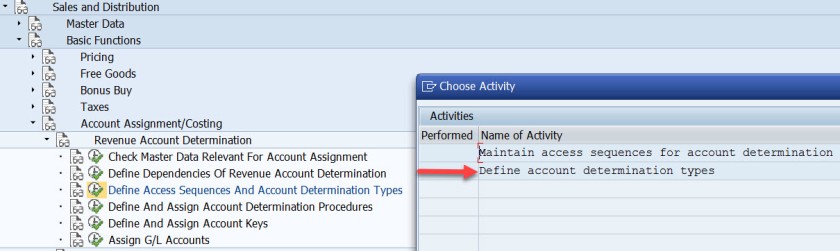

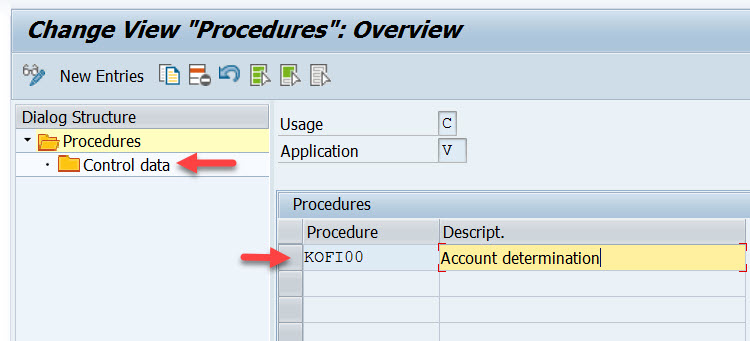

Choose the option as pointed to create account determination procedure.

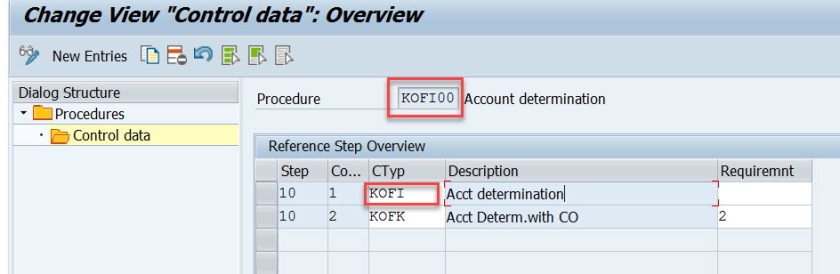

Procedure KOFI00 is created and assigned to the account condition types. Choose the procedure and select Control data from left side.

Here the account determination procedure is assigned to the condition type.

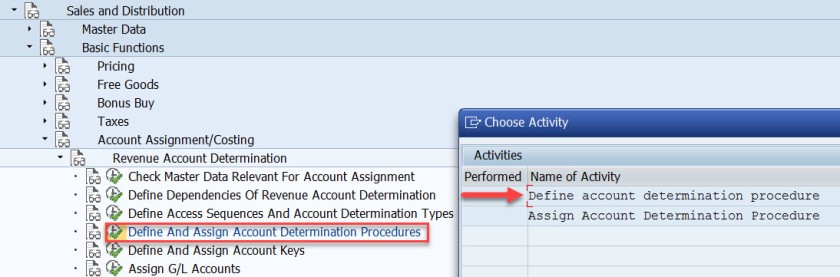

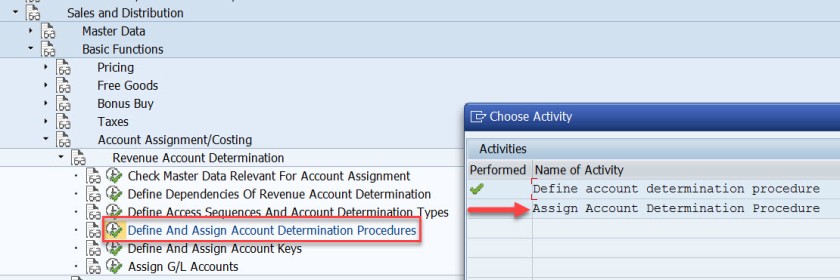

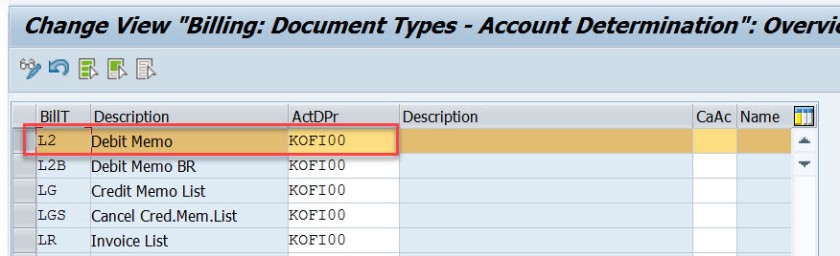

Choose the option – Assign account determination procedure.

Here the account determination procedure is assigned to the billing type.

Next step is to define account key. Choose the marked option.

For different types like revenue, tax and other different account keys are defined. For revenue its ERL.

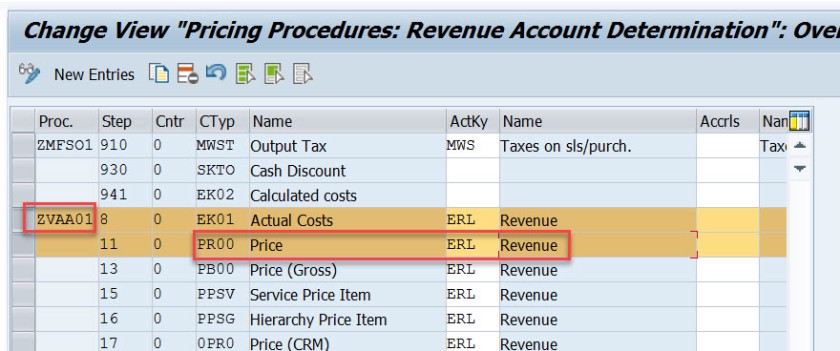

Next step is to assign the account key to the pricing procedure – condition type PR00.

Here for the pricing procedure ZVAA01 and condition type PR00, the account key is assigned as ERL.

In the above created sales order, item we can check the pricing procedure as below bu selecting the Analysis button in the conditions tab of the item detailed screen.

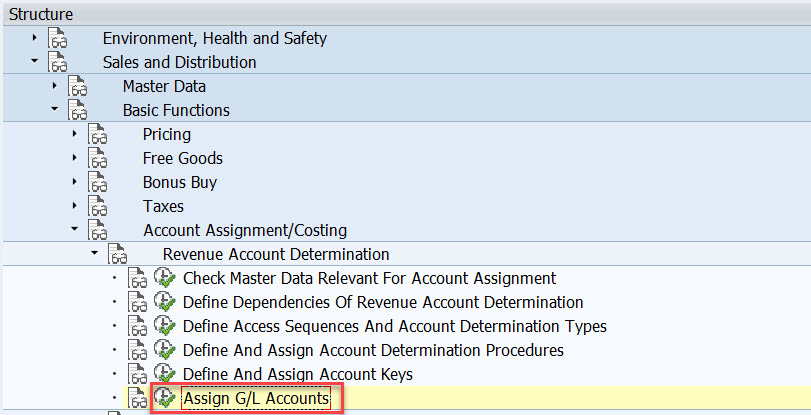

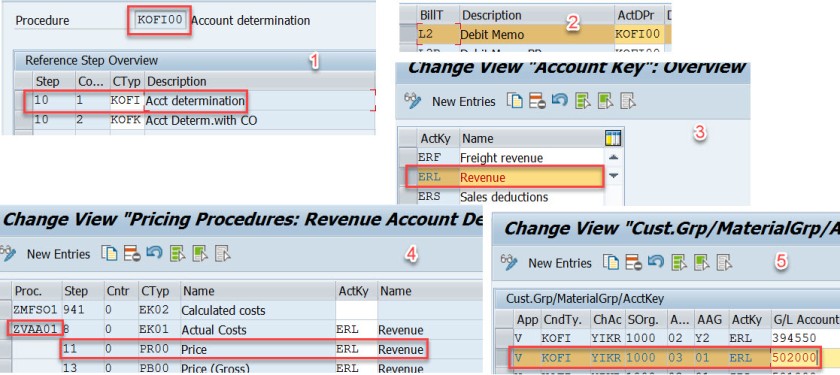

Next time is to assign the G/L account. Choose the marked option.

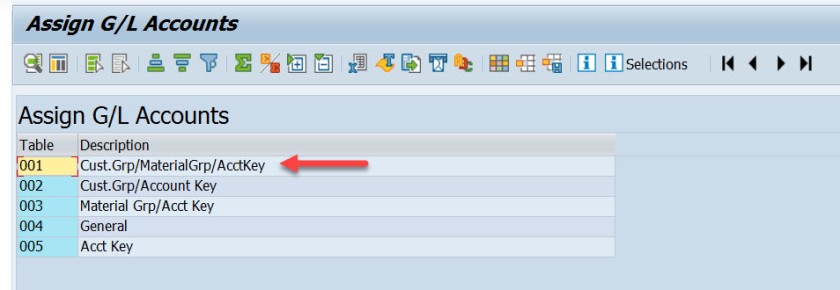

Here we have five options. as account condition type KOFI of the account determination procedure KOFI00 is assigned to the access sequence – KOFI with five access lines.

This is like maintaining the condition records. During the GL account determination process, it checks to find the GL account by taking all the values from the billing document and checking against the condition records for table 001. If found it calculated the G/L account and if not found then checks for the condition records for the second table and so on upto 005 until it finds a G/L account.

Choose/double click on the first line.

Here we have maintained for V-Sales, KOFI- account condition type, YIKR as the chart of account and other four fields like sales org, customer account group, material account group and account key comes from the condition table, for our demo purpose we have assigned the G/L account as- 502000.

( Before assigning to the G/L account here it should be created first).

For our demo

- From Billing Type L2 it derives the account determination procedure as- KOFI00

- From account determination procedure- KOFI00 it find the account condition type as – KOFI

- During creation of billing its finds for the item, pricing procedure and the condition type as PR00

- Then it finds the account key for the pricing procedure with condition type PR00 as ERL

- The customer account assignment group is – 03

- The material account assignment group is – 01

- The chart of account as- YIKR fot the company code- 1000

- By taking all these values, the G/l account number calculated as – 502000

Very well explained

LikeLike

Can you please explain me how to assign different GL account while creating accounting document? What changes do I have to make?

LikeLike

is there any way to do a mass analysis on how account assignment has been done over a period of time? ie which tables were used with with criteria? We want tot clean up the SD account assigment tables which currently have over 100.000 entries and are not manageble anymore.

LikeLike

It’s truly a nice and useful piece of info. I’m happy that you shared this useful info with us.

Please keep us up to date like this. Thank you for sharing.

LikeLike

Hi. I have an inquiry regarding the classification of ERL account group. In my current company, there are two GL accounts which are currently tagged to ERL (Revenue) – one is cash and another is VAT adjustment (based on their description). My question is, are those two accounts valid to be determined under ERL? If so, what is the impact if this matter is unresolved? Hope someone can take up and provide me a good input. Many thanks in advance.

LikeLike

t5tnp8SKS

LikeLike

this is how the fucking a document must be. excellent!

LikeLike

Thank you so much, detail explanation. Appreciate the hard work

Could you add little detail on ” how does the pricing procedure ZVAA01 and condition type PR00 linked/determined for an item”

BR / Bose

LikeLike

Pricing procedure is not determined on the item level. Pricing Procedure is determined on the header level. In tx- OVKK , the determination of pricing procedure customizing are maintained.

The sales area, document pricing procedure and the customer pricing procedure determines the pricing procedure.

When an order is created we know the sales area(sales org, dist channel and division), the document pricing procedure derived from the document type and from the sold-to-party (customer) the customer pricing procedure is derived. With all these information, Pricing procedure is derived.

The pricing procedure contains condition types like PR00 and others.

In Tx- VK11/VK12/Vk13 we can maintain pricing condition records against each condition types.

When we enter a material in an item, from the already determined pricing procedure it gets the condition types and tries to find the pricing condition record for the material. This is how the price is found for that item condition type.

Hope this helps!

LikeLiked by 1 person

Thanks to you Siva and Manish, I am not in to SD but was trying to have extended understanding between FI-SD integration and found your tutorial, its really help full. I was going through with the tutorial and played your videos as well in you tube. It helps me to understand the process and bridge the gaps from SD side. Really appreciate your effort on preparing and sharing the knowledge

BR/ Bose

LikeLike

Thanks for the details .suggest reading the note on account-determination helpful things are described there

LikeLike

execellent..well done..thank you

LikeLike